Another unicorn has fallen. The Good Glamm Group’s breakdown has been coming for months, but this week CEO Darpan Saghvi made it official.

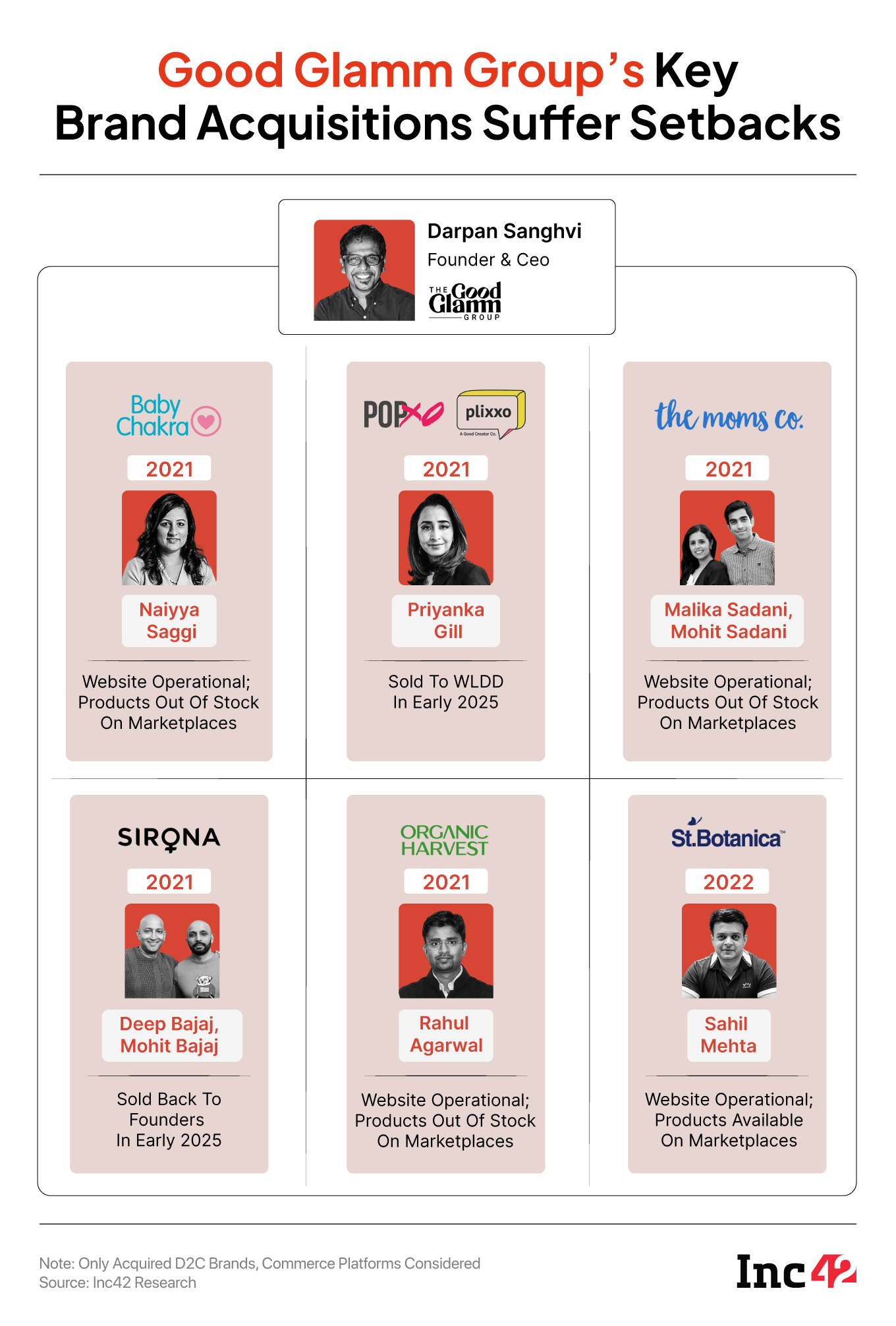

The company will look to sell off its acquired brands after already offloading a bunch of acquired companies in the past year. The GGG situation is a bleak example of what happens when startups go on acquisition sprees with millions of dollars in VC funding with no strategy in place — mirroring what happened at BYJU’S.

Both unicorns now lie in dust with their assets being sold off or potentially being liquidated. So this Sunday, we look at everything that went wrong in the Good Glamm Group story. Before that, a look at a few of the top stories from our newsroom this week:

- India’s Satcom Dream: Satellite communications are pivotal to the Centre’s target of connecting 1.2 Bn Indians to the internet via personal devices by 2025–26. But, how is India placed on the regulatory front and what role do startups have in this game of satellites?

- Can Zoho Redefine Enterprise AI? With AI taking the world by a storm, the SaaS giant startup recently rolled out its indigenously-built AI suite, Zia LLM, and began offering the product for free to its clients. So, is Zoho moving away from its traditional SaaS roots?

- Akshayakalpa’s INR 500 Cr Run: Having stared at potential shutdowns six times in its nine-year lifetime, the D2C dairy brand today has built an organic dairy brand that is on track to exceed INR 500 Cr in sales. So, how did the startup manage to carve a niche in the market?

After months of turmoil, Good Glamm Group’s lenders enforced their charges on the individual brands under the group and will look to sell these brands off. With this Good Glamm Group’s content-to-commerce house of brands has come crashing down, an outcome that leaves Sanghvi with plenty to answer for.

The founder claimed selling the assets and brands is the last resort for the company, which failed to secure refinancing or any other investments since 2021. It has survived on venture debt and loans, but now the lenders have come for the assets as the company is unable to repay its debt.

“The decisions, the choices that didn’t work, the risks that didn’t pay off, and the people who have been impacted: employees, vendors, partners, lenders, shareholders. I understand, just saying “I’m sorry” isn’t enough. I take responsibility, and responsibility isn’t just about reflection, it has to be commitment,” Sanghvi lamented, and said that he would personally compensate employees who have been left unpaid for months.

The Good Glamm Group’s lenders are now working on selling the brands individually with multiple owners expected. They could end up being owned by separate companies, which would make their individual futures uncertain.

The fact that Good Glamm Group had backers such as Amazon, Bessemer, Accel, Wipro Consumer Care Ventures or that it had raised more than $360 Mn in funding in just four years was not enough to save the company.

Millions of dollars and an appetite for acquisitions does not guarantee success, profits or even revenue as evidenced by the fate of BYJU’S. And now Good Glamm Group is in the same boat.

Good Glamm Group’s Bad PlanningGiven that brands are being sold off separately, there is no doubt that the core reason for Good Glamm Group’s failure is that its acquisition strategy was wrong and did not account for integration of various brands. Crucially, key success owners within these brands were not given operational prominence in the house of brands, resulting in poor transition.

As one founder who was part of this acquisition spree told Inc42, it was a bit like adopting several children and then forgetting about their individual growth needs. The company’s centralised management structure for various brands was largely to blame, we were told.

“It is not possible to acquire a brand and simply own it without retaining the product’s core values and ethos. This was the big error by Darpan [Sanghvi] as a more central figure could have been played by founders like us who knew the acquired brands better than the group’s central management,“ added the founder of a brand which was acquired and then put on the selling list within two years by the Good Glamm Group.

With brands such as MyGlamm, Moms Co, Organic Harvest, St Botanica now being put up for sale, the startup’s venture debt investors — Stride Ventures, Alteria Capital and Trifecta Capital — would be looking to recover some of the funds invested in the company.

As Inc42 reported in early July, lenders hadalready stepped in to steer the ship and Arjun Vaidyanathan, a former KPMG professional, was appointed to oversee the restructuring in January this year. Since then most of the costs have been gradually cut out of the company. Employees were asked to move to work from home, and office spaces were vacated.

The Unanswered QuestionsIn his post about the company’s demise, Sanghvi hinted that the rough timeline for the sale would be 60 days. During this time, he said he would set up a new “Good Glam Restitution Fund” to clear the dues, if any remaining, of employees, vendors/partners and for “losses incurred by our shareholders”.

What this looks like is unclear, but Sanghvi needs to answer for what went wrong with the company which raised more than $350 Mn in funding in its short lifetime.

Even as multiple key leaders — who were founders of the acquired brands — quit the company, no questions were answered about the state of affairs and why the company had not disclosed its financials.

Representatives of its key investors who were on the board stepped down — just like in BYJU’S — giving the impression that nothing was going right. But despite these issues, Sanghvi rarely answered the tough questions.

And again, just like BYJU’S, he’s taking personal responsibility for compensating employees, even though his claim on social media cannot be taken as gospel or a guarantee. Eventually, this was a company with thousands of employees and dozens of D2C brand founders who were passionate about their own brands, and not letting them run those brands within Good Glamm Group was a misstep.

This week, Sirona founder Deep Bajaj was at Inc42’s D2C & Retail Summit 2025, excited about reviving the brand and starting again after first selling to GGG and then buying Sirona back. Similarly, it’s likely that some other brands such as Organic Harvest are bought back by the founders from GGG.

Ultimately that would be the best outcome from the Good Glamm Group’s fall, however, it’s not a certainty by any means. Even under that scenario, failure of this magnitude does have consequences that tend to have ripple effects beyond just one unicorn.

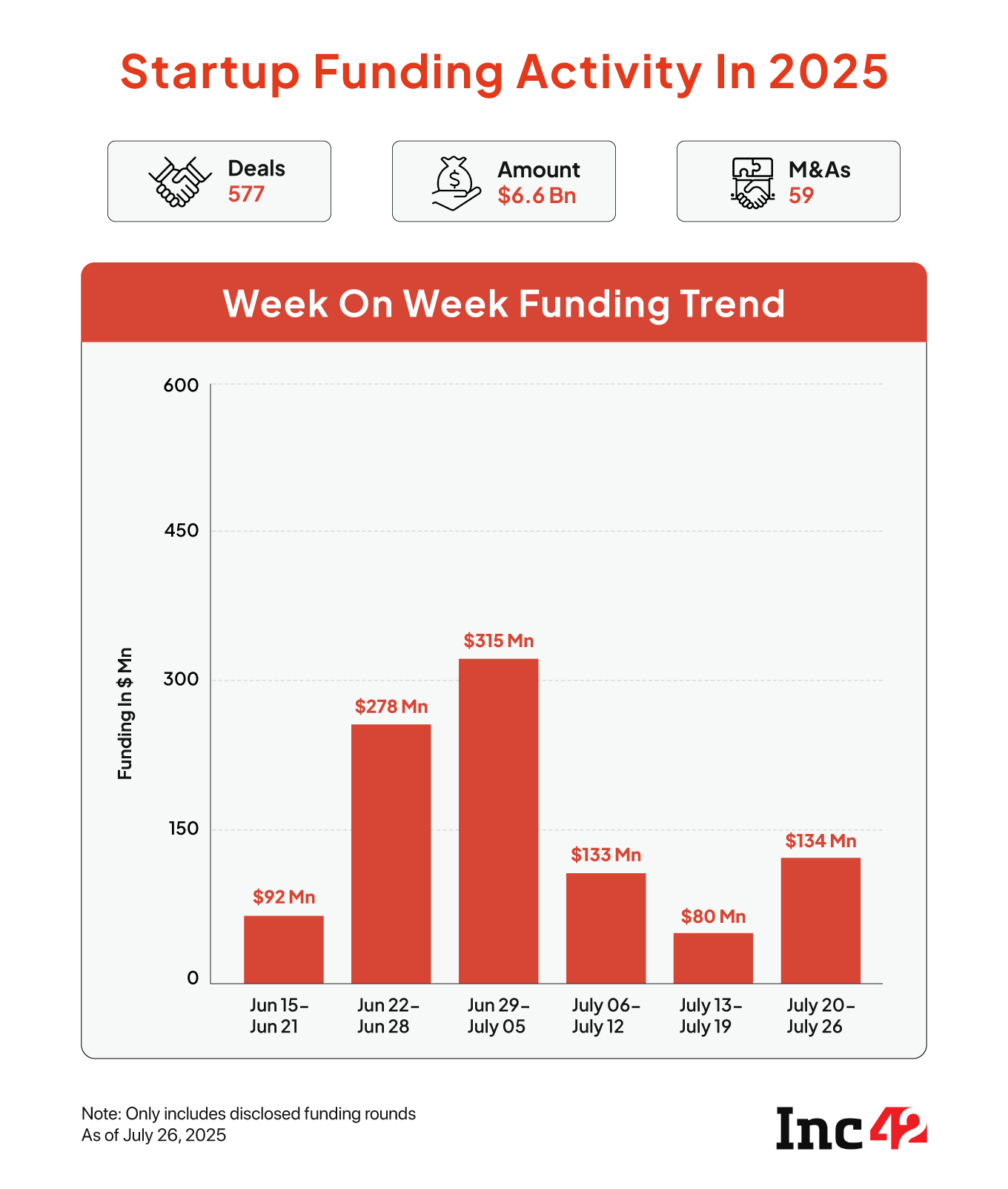

Sunday Roundup: Startup Funding, Deals & More- A Minor Spike In Funding:Between July 21 and 26, 22 startups raised $134 Mn, marking a 69% uptick from the $79.7 Mn raised by 21 startups in the preceding week. Unicorn India Ventures was the most active investor this week, backing semiconductor startup Netrasemi and AI startup Kluisz.ai

- BigBasket Takes A Hit In FY25: Amid intense competition, the quick commerce platform’s revenue fell 3% YoY to INR 7,673 Cr in FY25 while net losses zoomed 46% YoY to INR 1,851 Cr. However, online pharmacy1mg’s turnover jumped 20% YoY to INR 2,392 Cr in FY25

- ED Books Myntra, Simpl: The enforcement agency has filed a complaint against the fashion marketplace for flouting FDI norms to the tune of INR 1,654.4 Cr. Theagency also booked the BNPL startup and its cofounder over the same allegation, involving a sum of INR 913 Cr

- The $44 Mn Heist At CoinDCX: Days after hackers decamped with $44 Mn in assets from the crypto exchange’s coffers, the hunt is on to recover the funds and ascertain the identity of the malicious actors. But, how were the servers of CoinDCX breached?

- PW’s IPO Gets SEBI Nod: Just four months after filing its DRHP via confidential route, PhysicsWallah has received the markets regulator’s approval for its IPO. As per reports, the edtech major is looking to raise $531 Mn via its public listing at a $3.7 Bn valuation

The post The Good Glamm Group’s House Of Cards Crashes appeared first on Inc42 Media.

You may also like

Mumbai: Mobile Thefts, Unauthorised Persons Found Sleeping At Night In V N Desai Hospital

Actor Madhampatty Rangaraj Marries Stylist Joy Crizildaa Again & Announces Pregnancy Months After First Wife Shruthi Denied Divorce Rumours

Security forces demolish Maoist memorials as banned outfit seeks sympathy by observing 'Martyr Week'

Mansa Devi Temple Stampede: President Murmu, PM Modi Express Condolences To Families Of Those Who Lost Their Lives

PM Modi expresses grief over loss of lives in Mansa Devi stampede